Tokenomics

This term sheet outlines the key terms and conditions for the token sale of Messiah. It provides a summary of token supply, pricing, allocation, vesting schedules, and other relevant details.

1. Overview

- Token Supply: 100,000,000 tokens

- Initial Liquidity Pool: $300,000

- Listing Price: $0.050 per token

- Buy Tax / Sell Tax: 4% / 4%

- Token Audit: Hacken

The token sale is designed to fund project development, incentivize early participants, and ensure long-term ecosystem sustainability through structured vesting.

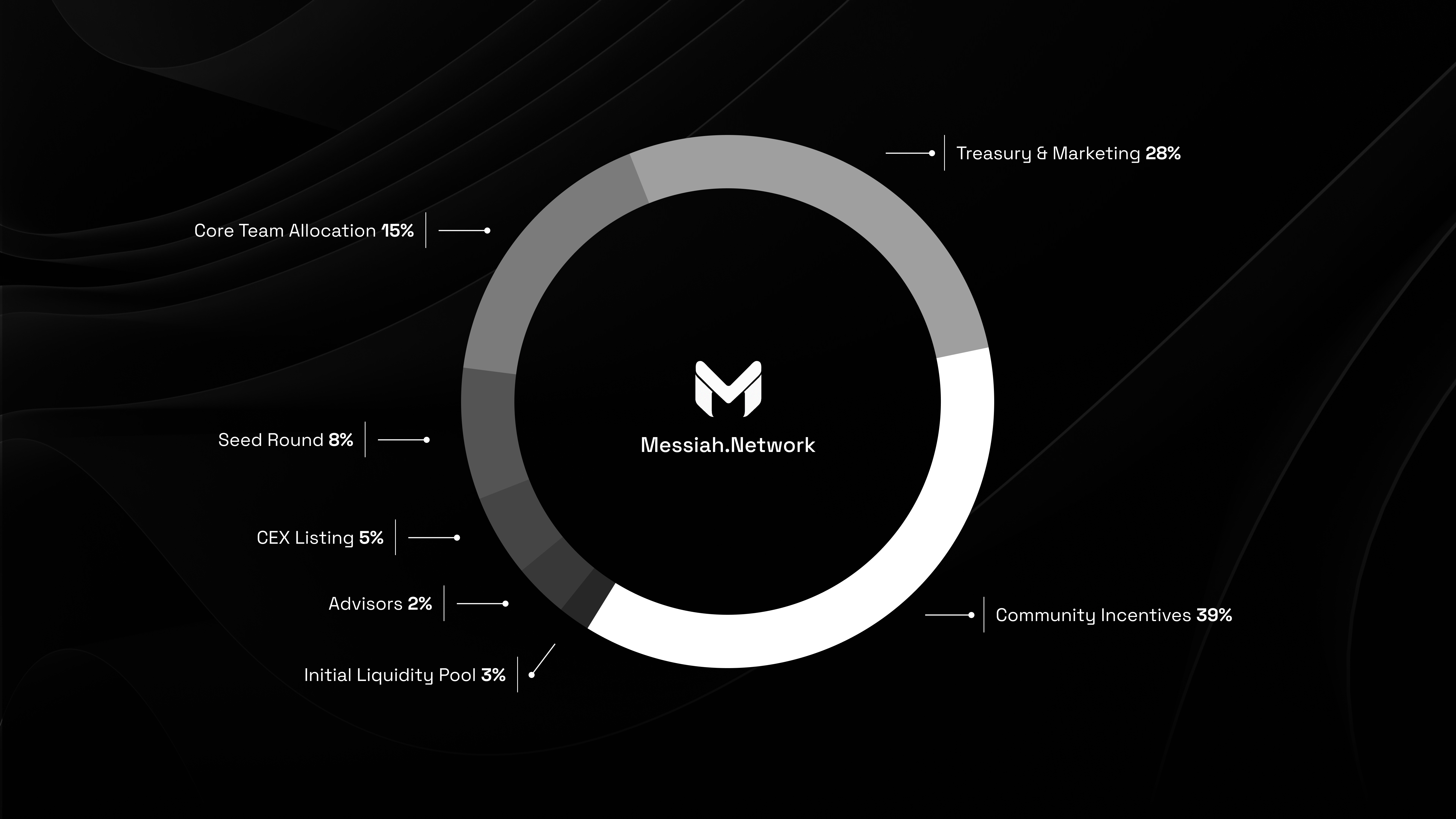

2. Token Supply and Allocation

The total supply of 100,000,000 tokens is allocated as follows:

| Category | Allocation (%) | Tokens | Description |

|---|---|---|---|

| Seed Round | 8% | 8,000,000 | Early stage investors and backing. |

| Inital Liquidity Pool | 3% | 3,000,000 | Open sale to the public at TGE. |

| Community Incentives | 39% | 39,000,000 | For airdrops, staking rewards, liquidity mining, and ecosystem grants. |

| Core Team | 15% | 15,000,000 | To align team incentives with project success. |

| Treasury & Marketing | 28% | 28,000,000 | For strategic initiatives, partnerships, and marketing. |

| Advisors | 2% | 2,000,000 | For advisor compensation and guidance. |

| CEX Listing | 5% | 5,000,000 | For liquidity and support on centralized exchanges. |

-

Seed Round (8,000,000 tokens):

- TGE Unlock: 30% immediately available at TGE

- Vesting: Remaining 70% vests linearly over 9 months

-

Inital Liquidity Pool (3,000,000 tokens):

-

Community Incentives (39,000,000 tokens):

- Immediate Pool (10,000,000 tokens): Available at TGE or shortly after for initial programs.

- Ongoing Programs Pool (29,000,000 tokens): Vests linearly over 1 year, starting 1 month after TGE, for sustained community initiatives.

-

Core Team (15,000,000 tokens):

- Subject to a 3-month cliff from TGE.

- After the cliff, tokens vest linearly over 12 months (total vesting duration: 15 months from TGE).

-

Treasury & Marketing (28,000,000 tokens):

- 5% unlocked at TGE for initial marketing efforts.

- Remaining 95% vests linearly over 36 months, starting 3 months after TGE, for ongoing strategic needs.

- Strategic Partnerships

-

Advisors (2,000,000 tokens):

- Subject to a 6-month cliff from TGE.

- After the cliff, tokens vest linearly over 12 months (total vesting duration: 18 months from TGE).

-

CEX Listing (5,000,000 tokens):

- Released strategically as needed for exchange listings and liquidity provision, with releases managed over 12 months post-TGE to minimize market impact.

3. Security & Audit

We’ve prioritized safety, transparency, and fairness from the start:

🔗 Audit Report: https://hacken.io/audits/messiah-network/

We designed the vesting structure to ensure balance: early supporters get rewarded for their risk, while a gradual unlock protects the market and encourages long-term alignment. Seed tokens will also be offered via OTC, bypassing market pressure and minimizing impact on price dynamics.

4. The Economy Behind the Messiah Token

The Messiah token is designed for stability and long-term, sustainable growth. Our approach is built on three core pillars: a strong market foundation, a proactive treasury, and a clear path toward community ownership.

🏗️ Pillar 1: A Strong Foundation at Launch

We’re launching with a significant 150,000 of our own capital with 3% of the total token supply. This deep liquidity from day one is a strategic choice to:

- Protect the Market: Creates a stable trading environment, minimizing volatility and ensuring a fair price for everyone from the start.

- Build Real Momentum: Attracts serious, long-term investors and helps establish a healthy, organic price floor for future growth.

💰 Pillar 2: A Proactive Treasury for Growth

A 4% tax on all buys and sells funds our multi-signature Treasury wallet. To protect our community, this tax is designed with a permanent ceiling:

- Maximum rate locked at 4% after launch, only adjustable downward.

- Clear roadmap to lower this tax as we hit key market cap milestones, with the ultimate goal of becoming tax-free.

This strategic funding empowers us to:

- Strategic Buybacks and Burns: During market downturns, buy back tokens to defend key price levels and show confidence in the project's value and burn tokens at key market cap milestones.

- Reinforce Liquidity: After strong growth, add more liquidity to solidify new price levels and prepare for the next leg up.

- Airdrops and community incentives tied to growth metrics.

- A roadmap for governance integration, ensuring community-led development.

🌱 Pillar 3: Empowering Our Community

Our ultimate goal is a self-sustaining ecosystem owned and governed by the community.

- Rewarding Holders: Immediately after launch, roll out LP mining, staking, and bonding programs so you can earn rewards and help decentralize supply.

- All related contracts will be fully audited by Hacken for your security.

- Creating Permanent Value: As the project matures, use a portion of the Treasury to permanently burn tokens, reducing total supply and increasing scarcity and long-term value.

3. Seed Round Context

The seed round was critical in getting Messiah off the ground. Every participant is a trusted partner — individuals we've worked with in the past and have strong relations who backed us from day one. These investors are strategic allies who will act as a council alongside the community to help steer the project as it evolves.

4. Core Team Vesting Emphasis

To underline our commitment, core team tokens are subject to a 3-month cliff and then vest linearly over 12 months — and are excluded from initial circulating supply. This reduces the initial market cap and reinforces our long-term dedication to the project's success.